is an inheritance taxable in michigan

Profit from the sale of assets. The computed credit is reduced by 10 percent forvery1000 e or part of 1000 that total household resourcesxceed e 51000.

Michigan Inheritance Laws What You Should Know

Other items taxable under Indiana state law include.

. Business and farm income. As a percentage of price either the retail or wholesale price based on weight ie per ounce and based on the drugs potency ie THC level. Can a Property be Sold before Probate is Granted.

What Are Allowable Deductions. If you give assets away and you survive for at least 7 years then all gifts are free and avoid inheritance tax. It has an inheritance tax and property taxes are higher than average.

Michigan does not have an estate or inheritance tax. Marijuana sales are legal and taxed in nine states. Make sure you keep below the inheritance tax threshold.

Income Tax Range. Colorized coins black rutheniumgold plated coins etc Iowa State Information. Some ways in which Pennsylvania is not quite so retirement tax-friendly.

If filing a part-year return you. Processed items - Such as products that were processed by third parties and have more value than their original precious metals content eg. Michigan has a flat tax rate of 425.

Twelve states and Washington DC. How to Stop a Solicitor or Bank being the Executor. The tax for diesel fuel is the same.

Maryland is the only state to impose both. Impose estate taxes and six impose inheritance taxes. Retirees with income from other sources may still be required to pay federal income.

It is possible to reduce taxable income by contributing to a retirement account like a 401k or an IRA. Is Social Security taxable in Pennsylvania. The new inheritance tax allowance on property can be found here.

Cities can levy income taxes as well on both residents and non-residents who are taxed 12 the rate of residents. Estate Funds Distributed to Charities a Probate Case Study. The taxes may also be referred to as income tax or capital taxA countrys corporate tax may apply to.

Inheritance Tax You Only Have 6 Months to Pay. Capital gains in Michigan are taxed as regular income at the state rate of 425 though certain local jurisdictions may charge more. There are no taxes on Social Security retirement benefits in Pennsylvania.

Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as. Mayotlaim n c a property tax credit if your taxable value exceeds135000 excluding vacant farmland classified as agricultural. Executor of a Will Duties and Responsibilities.

Many countries impose such taxes at the national level and a similar tax may be imposed at state or local levels. Give your assets away. If you die within 7 years then inheritance tax will be paid on a reducing scale.

Accessories - Such as holders tubes coin flips and similar apparel. Are Inheritance Tax Rules Different If Youre Married. Michiganders currently pay a gas tax of 2630 cents per gallon.

States currently levy three types of marijuana taxes. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. The taxes are calculated based on the taxable estate value and estate and inheritance taxes must be paid before the assets are distributed to the beneficiaries.

Taxable unearned income may include. A corporate tax also called corporation tax or company tax is a direct tax imposed on the income or capital of corporations or analogous legal entities.

Michigan Estate Tax Everything You Need To Know Smartasset

Inheritance Tax Here S Who Pays And In Which States Bankrate

Essential Qualities For Becoming An Inheritance Tax Specialist Tax Accountant Tax Preparation Inheritance Tax

What Is Inheritance Tax And Who Pays It Credit Karma

Lower Tax Bill In Florida South Florida Real Estate Florida Real Estate Florida

Michigan Inheritance Tax Explained Rochester Law Center

Michigan Estate Tax Everything You Need To Know Smartasset

Pin On Knia Law Office Okmulgee Lawyers

What Is Inheritance Tax Probate Advance

Is Your Inheritance Considered Taxable Income H R Block

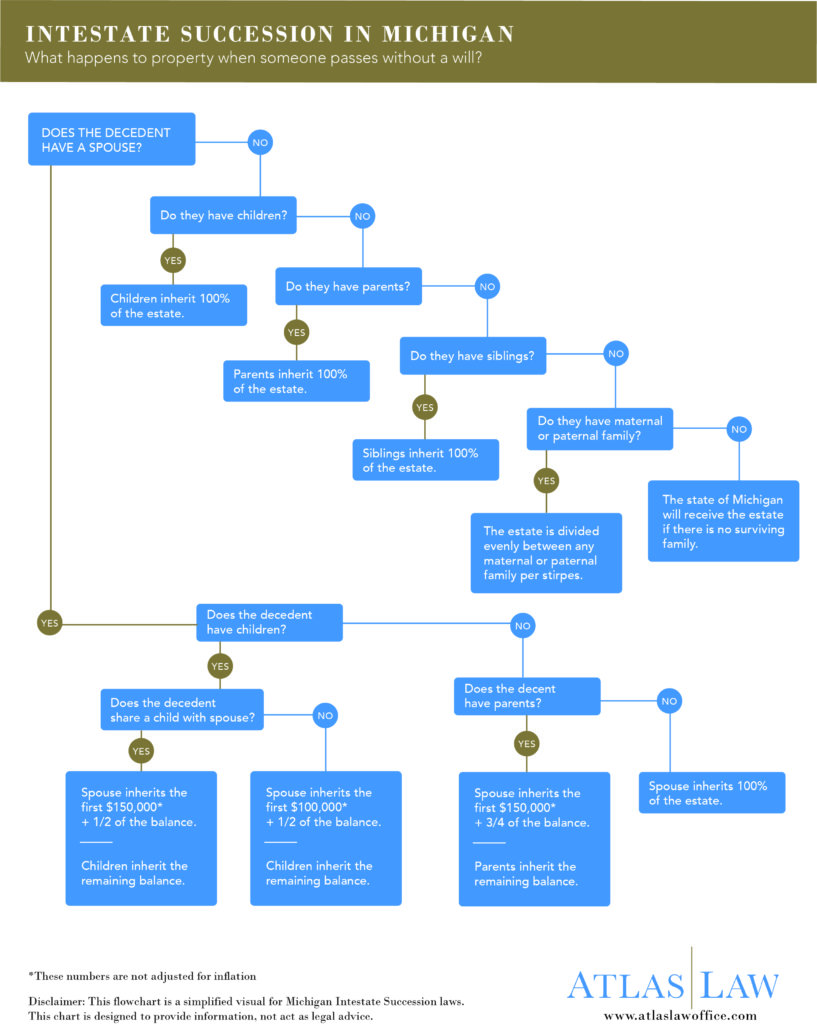

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Examples Of Expansionary Monetary Policies Monetary Policy Financial Literacy Loan Money

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What Taxes Are Associated With An Inheritance Rhoades Mckee